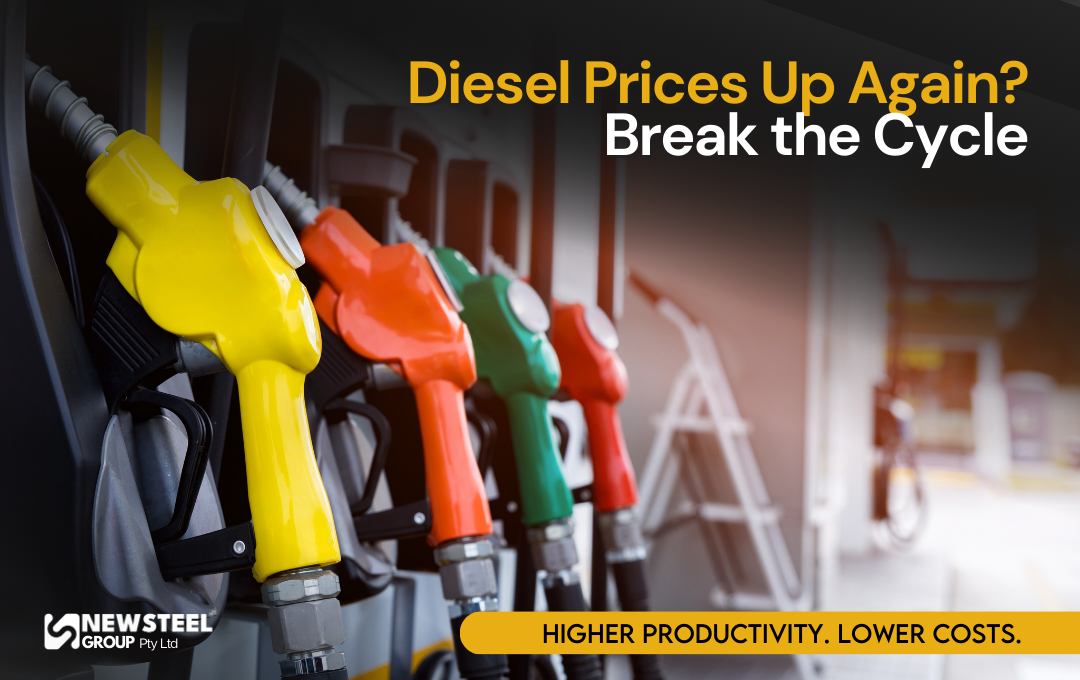

Rising Diesel Prices: Shield Your Operation from Market Volatility

Financial planning in a mining operation demands precision. However, it crumbles against one uncontrollable variable: the cost of fuel. Every budget is approved with projections that quickly become obsolete. News of rising diesel prices isn’t just a headline. It’s a direct command to slash margins, postpone investments, and re-evaluate project viability. This constant struggle to absorb unpredictable costs shifts the company’s focus. It moves away from what truly matters—innovation and growth—to merely surviving the next market fluctuation. Is this the business model you want to build your future on?

The Unending Cycle of Fuel Volatility

Reliance on fossil fuels chains operations to a cycle of instability beyond their control. Diesel prices don’t just respond to local supply and demand. They also reflect geopolitical tensions, currency fluctuations, and complex global supply chain dynamics. Consequently, trying to forecast these costs is like navigating a storm without a compass.

This scenario directly impacts the cost structure of any intensive operation. Fuel is often one of the most significant items in the operational expenditure (OPEX) budget. It becomes an unmanageable variable. A project that was profitable on paper can become unviable in weeks. This vulnerability affects quarterly results and limits the company’s ability to invest, as resources are diverted to cover unforeseen expenses.

How to Shield Your Operation from Rising Diesel Prices

Faced with this outlook, the instinctive reaction is to seek marginal efficiencies. This might include optimizing routes or negotiating with suppliers. However, these are temporary fixes, not a definitive cure. The real solution is to eliminate the dependency at its root. The most effective strategic shield against fuel market volatility is the transition to a stable, predictable energy source: electricity.

Converting heavy machinery to 100% electric systems represents a paradigm shift. Instead of being at the mercy of a global market, companies can operate with a predictable energy cost. This cost is negotiated in long-term contracts, offering near-total stability. As a result, news of rising diesel prices ceases to be a crisis. It becomes irrelevant to the core business.

Electric Conversion: Benefits Beyond Savings

Adopting electromobility with NewSteel’s technology is a key strategic decision. It strengthens the operation on multiple fronts and offers advantages far greater than simple fuel savings.

Long-Term Financial Predictability

The most immediate benefit is transforming a volatile expense into a fixed, known cost. With electric power, financial officers can forecast budgets with precision. This stability allows for bolder, more secure planning. It facilitates investment decisions without the constant fear of an external event derailing the finances.

Operational Efficiency and Reduced Maintenance

Electric motors are inherently more efficient and simpler than combustion engines. They have fewer moving parts and require no oil changes or complex exhaust systems. This drastically reduces maintenance costs and downtime. Therefore, for every hour a diesel machine is in the workshop, an electric one is productive.

Sustainability as a Competitive Advantage

In today’s market, environmental performance is a decisive factor. Reducing the carbon footprint and eliminating emissions does more than comply with strict regulations. It also strengthens the brand’s image. An operation committed to clean energy positions itself as a leader, attracts ESG-focused investors, and gains a tangible competitive edge.

A Strategic Move for a Resilient Future

Continuing to be exposed to fuel volatility is a risky gamble. Every report on rising diesel prices highlights the fragility of an outdated energy model. The conversion to electric systems from NewSteel is more than a simple tech upgrade. It should be seen as a declaration of energy independence and an investment in resilience. The ultimate goal is to take control of costs, strengthen the operation, and lead the way toward a financially predictable industry.

If your operation is ready to break the cycle of volatility and build a stable financial future, it’s time to talk. Follow us on our social networks to stay up-to-date with the latest innovations, or contact us directly for a personalized consultation.

- LinkedIn: NewSteel Global

- Instagram: @newsteel_global

- WhatsApp: +61 415 667 915